As Soon As you’ve selected the right model, the subsequent step is to create your company profile. This includes entering primary particulars about your construction enterprise, similar to your small business name, address, tax ID quantity, and make contact with info. It’s important to be accurate here, as this information will be used on invoices, tax filings, and other necessary paperwork. First things first, you may must resolve which model of QuickBooks is best for you. QuickBooks provides several variations, including QuickBooks Online and QuickBooks Desktop.

Step 6: Link Your Financial Institution Accounts And Bank Cards

You might have to create customized accounts like “Job-Specific Expenses” or “Work-in-Progress” to track project costs effectively. QuickBooks lets you tailor your Chart of Accounts to fit the particular needs of your construction business. Sure, QuickBooks Contractor Version allows customers to track dedicated prices. By coming into bills such as buy orders and subcontractor agreements, contractors can monitor the entire costs already allocated to a project however not yet paid. This function helps businesses see the full financial commitment of each job, examine it to budgets, and anticipate money circulate wants. Committed value monitoring is particularly priceless in managing massive projects, permitting contractors to remain inside finances and avoid overspending.

- With its automated calculations, you can keep away from the effort of manual payroll processing.

- QuickBooks offers the instruments to trace every penny, guaranteeing you keep profitable while assembly your client’s expectations.

- Start by choosing a standard report, like a Profit & Loss or Job Costing report.

- QuickBooks helps simplify invoicing by permitting you to create project-specific invoices.

Working with 1099 staff means you have to file the 2 1099 varieties listed right here. Let’s look slightly more in-depth at what these types mean and what they need. Since we’ve described that course of above, we’ll go through the method on QuickBooks Desktop right here. With its easy integration with different tools like Workyard, QuickBooks Online becomes a flexible platform to streamline cost processes and improve total workflows. Talk overtly with contractors about payment schedules, strategies, and any potential points.

Issue 2: Delayed Funds

QuickBooks has instruments designed specifically to handle this complexity. Development businesses usually work on multiple initiatives at once, and every job has its personal set of expenses, invoices, and payments https://www.quickbooks-payroll.org/. To observe prices accurately, you’ll need to arrange a job costing system in QuickBooks. This will allow you to assign costs to particular projects (like supplies, labor, and subcontracts) and monitor the profitability of every project. If you work with contractors, you know that environment friendly payroll administration is a should. Selecting the proper contractor payroll software can significantly impression your workflow, whether you’re a small business or a big enterprise.

If you employ Tipalti integration as your methodology for paying contractors, you’ll overcome a quantity of QuickBooks accounts payable challenges. If the payment was for a particular project or job, embrace notes for higher record-keeping. QuickBooks routinely tracks funds, guaranteeing accurate information for tax reporting and serving to you manage contractor expenses efficiently. In the construction world, workers are sometimes unfold across different job websites, making it more durable to track hours and ensure accurate pay. Using QuickBooks for payroll helps you keep compliance with tax laws, avoid late payments, and keep your employees pleased. It also ensures that your subcontractors and employees are paid correctly and on time.

Managing contractor payments is a key a half of running a construction enterprise, and QuickBooks On-line makes the process less complicated and more environment friendly. With its wide selection of features, it goes past primary accounting to supply an entire financial management answer tailor-made to fashionable enterprise wants. Contract labor on Schedule C refers to payments made to independent contractors or subcontractors, not employees, for work done on behalf of a business. Construction companies depend upon payroll to make sure everyone gets paid on time.

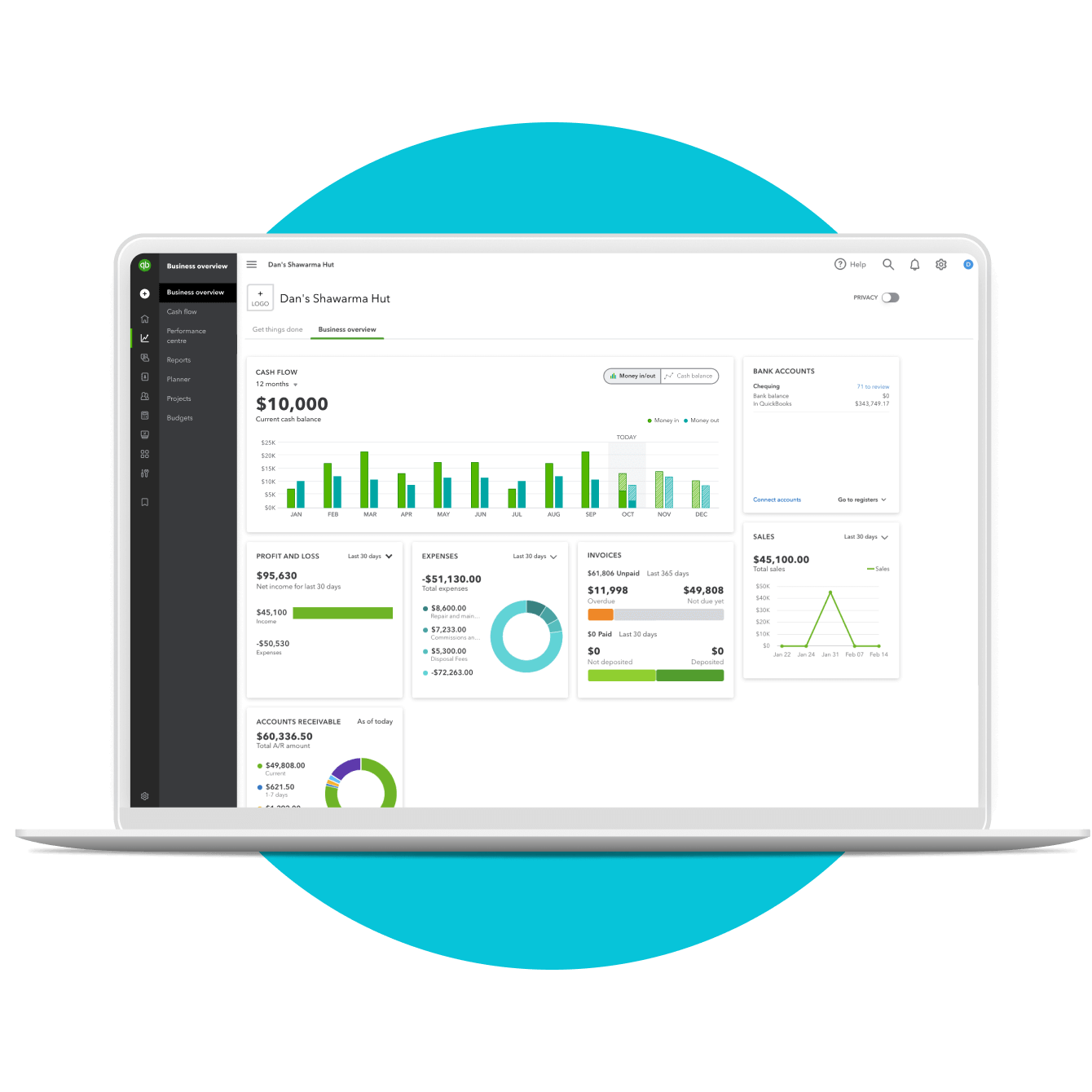

QuickBooks offers you the tools to record, categorize, and monitor every penny spent, so you can simply identify areas where you may be overspending or underbudgeting. Next, hyperlink your small business bank accounts and credit cards to QuickBooks. This will let you easily reconcile your accounts, track transactions, and handle your money circulate. QuickBooks can automatically obtain your bank and credit card transactions, saving you time and lowering errors.

Job Tracking Basics

QuickBooks Payroll will routinely calculate your payroll each month, ensuring on-time payments. To keep away from this, ensure you customize your chart of accounts in your particular development business needs. Break down classes like job costs, material expenses, and labor prices to track project expenses extra precisely.

With a safer quickbooks subcontractor report, easy-to-use platform and an average Pro expertise of 12 years, there’s no beating Taxfyle. QuickBooks Online, however, provides the convenience of cloud access, allowing you and your staff to collaborate in real-time from wherever. This version is ideal if you have to handle your funds on the go and want the convenience of accessing your knowledge anytime, wherever.

The software offers custom-made reporting to offer insights into your monetary health and project profitability. Industry-specific tools like job costing, time monitoring, and mileage tracking simplify your accounting duties and allow better project management. These extra options help building corporations and basic contractors maximize effectivity and take their enterprise to the subsequent stage. Workyard’s precise GPS-based time tracking ensures employee hours, additional time, and job-costing knowledge are captured accurately and fed immediately into ADP’s payroll system. This eliminates guide data entry, reduces payroll errors, and helps companies save money and time on payroll processing.